Within this energy transition plan we believe that the rooftop solar photovoltaic potential has not been fully realized and a lot can be done here. While India is considered one of the world leaders in utility-scale solar electricity generation, solar rooftop progress has been underwhelming. Within the rooftop solar sector itself, Commercial and Industrial (C&I) users account for ~70% of all the country’s rooftop solar installations. In this article, we’ll explore few of the key deterrents of solar rooftop adoption by MSME players through PPA model (also know as OPEX/RESCO model ) and how Clime Finance offerings can help SMEs (Solar EPC players or Small Scale Solar IPPs) with easy access to long tenured credit with low upfront investment.

Solar Rooftop Market Landscape: C&I and MSME (C&I) Market opportunity in India

According to the Ministry of New and Renewable Energy (MNRE), India’s cumulative rooftop solar capacity is approximately around 11 GW, as of September 2023 of which majority of the installed capacities cater to C&I sector. Until fiscal year (FY) 2019, rooftop solar installations in India were a meagre 1.8GW. Since then, the rooftop solar market has consistently grown by around 1.9-2.2GW annually. While there is traction on solar rooftop adoption in the recent times, India is still a long way from achieving its rooftop solar target of 40 GW.

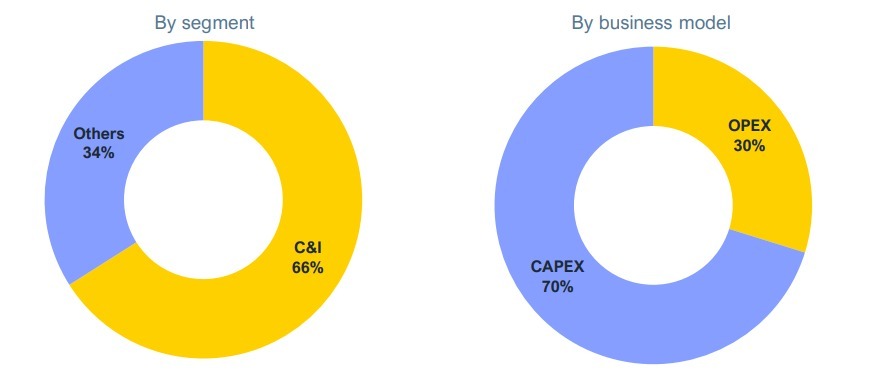

As per JMK Research-IEEFA’s analysisi , (Figure) C&I consumers constitute the bulk (~66%) of rooftop solar capacity in India. The other 34% of rooftop solar installations are in residential and government buildings. Conduciveness of operational and financing factors has help rooftop scale in the recent years. States like Gujarat, Andhra Pradesh and Telangana, and the union territory of Delhi, have the most favourable ecosystems for setting up rooftop solar projects. Conducive net metering policies, ease of regulatory approvals and potential monetary savings that a C&I consumer can realise by adopting rooftop solar influence a state's attractiveness. With increasing awareness and economic benefits for businesses will drive future growth in the rooftop solar market.

Figure: Breakup of Rooftop Solar Installations (as of 31 March 2023)

The JMK Research-IEEFA’s analysis suggests that the capital expenditure (CAPEX) model is more prevalent, with around 70% installed additions versus just 30% of OPEX model.

This split with 70% smaller rooftop projects being in CAPEX model is at a stark contrast with what we see in the large scale solar power generation projects in India. We note large scale solar projects across the world are now being done on OPEX/RESCO model that a) align the risks and rewards appropriately between the developer/installer and the consumers of solar power and b) offers immediate savings on energy costs of consumers of solar power.

Such large scale solar power adoption is possible owing to lower costs of solar panels, higher generation from experienced installers/ O&M players/ developers and availability of very long term and competitive financing of solar power projects.

We at Clime Finance believe that SME solar power developers and EPC players have a lot of experience installing and operating solar power projects and and are able to take advantage of lower costs of solar panels, they are unable to access competitive and long tenor financing and thus unable to deliver good value proposition of immediate savings on energy cost to their customers by installing behind the meter small solar rooftop projects.

While financing of larger solar power projects is available to large solar power developers in abundance in India, access to similar financing for smaller rooftop solar power projects to small EPC players and small scale developers is quite limited and restrictive in nature. The short term or high cost financing available for smaller rooftop projects does not allow for providing immediate savings to consumers that we see in the large scale solar power projects. We believe good financing options can allow for scale of of small rooftop projects for experienced installers/ developers and SMEs at large and help accelerate India’s green energy goals.

SMEs have limited access to competitive financing for rooftop solar projects due to various perceived risks, few are listed below:

The rooftop solar financing situation for the MSME segment has improved in the recent years but these are few. This progress is partly due to increasing awareness of MSMEs towards renewable energy adoption as well as lending institutions realising the potential of the untapped market for solar lending in the MSME segment. This potential is estimated to be around 15GW, which is around 37% of India’s rooftop solar target of 40GW.

How can Clime Finance help solar EPC players and small scale IPPs (MSME) scale their solar portfolio (PPA Model)?

Clime Finance offers tailor made products with an aim to address the key issues faced by SMEs especially Solar EPC players to adopt PPA model and Solar IPP- small scale projects, to encourage them to expand their rooftop portfolio (1MW or below projects).

Below are few of the key highlights that Clime Finance offers to encourage adoption of OPEX model for SME:

Conclusion:

The Commercial and Industrial (C&I) sector is set to drive future growth in the rooftop solar market as it is becoming increasingly economical for businesses. Easy and adequate access to financing to MSMEs will help more SMEs to switch to PPA/OPEX/Resco model in the growing solar rooftop sector. At Clime Finance, we’re committed to providing our customers with easy and quick disbursements to build solar rooftop portfolio. We are a dedicated team of experts with an in depth understanding of the sector and can offer a range of financing solutions to suit our client’s business needs and help our clients gain ownership of the solar assets.

Contact us at sales@climefinance.com or drop us your contact details to learn more about our financing solutions.

About Company:

Clime Finance is an RBI registered NBFC, focused on providing debt financing to founder led small and medium enterprises engaged in Climate adaptation and mitigation activities such as renewable energy, sustainable transport, sustainable agriculture, and digital enterprises. In addition, Clime Finance has a focus to finance SMEs that support products and services for women and/or are led by women.

Disclaimer: Issued by Clime Finance Private Limited (“CFPL”) for informational purposes only. This is not an offer, solicitation, or recommendation for any financial product or service. All financial products and services are subject to applicable laws and regulations, the terms and conditions that maybe specified by CFPL and due diligence of the prospective borrowers. CFPL assumes no responsibility or liability for any errors or omissions in this content. The information contained here is provided on an "as is" basis with no guarantees of completeness, accuracy, usefulness or timeliness.